We often stress about the importance of financial literacy, such as gaining a strong understanding of how money works and having the resources to make informed decisions.

But when it comes to establishing financial health, one thing most people fail to consider is their money personality type — or their approach and emotional responses to money.

We each have our own beliefs and emotions about money, and they are mostly shaped by our individual life experiences (e.g., passed down from our parents or influenced by our current situations).

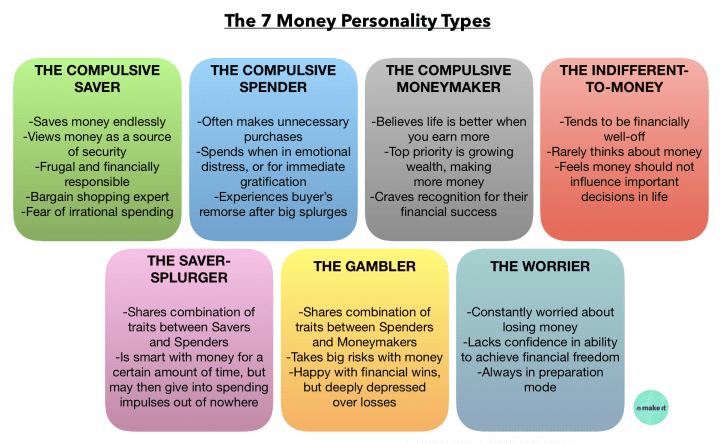

In my 10-plus years of researching the psychology of money and happiness, I’ve found that there are seven distinct money personality types. Typically, we fall into a combination of many types, and not just one.