|

Affinbank MasterCard Basic

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- A basic credit card with unlimited offers, benefits and credit lines at zero annual fee for life.

- Enjoy low interest rate starting at 2% that is charged only once upon application.

- Receive ONE-TIME upfront interest for as low as 6% and a fixed repayment tenure when you borrow up to 90% of your credit limit.

Cash Withdrawals

- Affinbank MasterCard Basic allows you to perform cash withdrawals for up to 3 transactions a day. However, there’s a cash withdrawal limit, which is 25% of the credit card limit or the available credit limit, whichever is lower. It is better to settle the withdrawal amount before the payment due date, otherwise, Affin Bank will charge you 17.5% p.a. on the outstanding balance.

Fees and Charges

- If you’re looking for your first credit card, you can consider Affinbank MasterCard Basic that provides credit card benefits without the annual fee. The fee is waived forever with no hidden conditions.

Are You Eligible For The Affinbank Master Card Basic?

- Anybody can apply for the Affinbank Master Card Basic with a minimum annual income of RM24,000. The individual must be at least 21 years old and above to hold a primary card and 18 years old above for a supplementary card.

Flexibility Fee and Charges

Balance Transfer

-

You are bound to miss your credit card payment if you hold multiple cards at the same time. Consolidate all outstanding balance into one manageable sum with this balance transfer and make full use of the low upfront interest rate charges you get.

Easy Payment Plans

-

Select your desired payment duration from 6 months to as long as 36 months for your purchases with Affin Bank Easy Instalment Plan.

Interest Rate Rebate

-

The credit card interest rate is also known as the finance charge, which starts from 15% p.a. up to 18% p.a., depending on how prompt you make your credit card bill payment every month. The minimum monthly payment is 5% of the outstanding balance or minimum of RM50, whichever is higher.

Card Information

-

-

-

Min. Monthly Income

RM2,000

-

Min. age for principal holder and supplementary holder

21 and 18 years old above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

2% one-time upfront handling fee |

RM500 |

| 12 months |

4% one-time upfront handling fee |

RM1,000 |

| 18 months |

5% one-time upfront handling fee |

RM2,000 |

| 24 months |

6% one-time upfront handling fee |

RM2,000 |

| 36 months |

7% one-time upfront handling fee |

RM3,000 |

|

|

Affinbank Visa Basic Card

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- A basic card that empowers your spending habit and simplifies cash flow management – all at zero annual cost for life!

- Say hello to ONE-TIME upfront interest for as low as 6% and a fixed repayment tenure when you borrow up to 90% of your credit limit.

Cash Withdrawals

- The cash withdrawal refers to the cash advance for the credit cards. You can withdraw cash from your Affinbank Visa Basic account for up to 3 transactions per day. The maximum withdrawal limit is 25% of your credit limit or available credit limit, whichever is lower. Besides that, if you are not able to repay the withdrawal amount before the payment due date, the finance charge between 15% to 18% p.a. will be incurred on your Affinbank Visa Basic account.

Fees and Charges

- If you’re looking for a basic credit card without expecting to pay the annual fee, Affinbank Visa Basic could be your choice. The annual fee is waived for life without any hidden charges or conditions.

Are You Eligible For The Affinbank Visa Basic Card?

- Anybody can apply for the Affinbank Visa Basic Card with a minimum annual income of RM24,000. The individual must be at least 21 years old and above to hold a primary card and 18 years old above for a supplementary card.

Flexibility Fee and Charges

Balance Transfer

-

You are bound to miss your credit card payment if you hold multiple cards at the same time. Consolidate all outstanding balance into one manageable sum with this balance transfer and make full use of the low upfront interest rate charges you get.

Easy Payment Plans

-

Select your desired payment duration from 6 months to as long as 36 months for your purchases with Affin Bank Easy Instalment Plan.

Card Information

-

-

-

Min. Monthly Income

RM2,000

-

Min. age for principal holder and supplementary holder

21 and 18 years old above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

2% one-time upfront handling fee |

RM500 |

| 12 months |

4% one-time upfront handling fee |

RM1,000 |

| 18 months |

5% one-time upfront handling fee |

RM2,000 |

| 24 months |

6% one-time upfront handling fee |

RM2,000 |

| 36 months |

7% one-time upfront handling fee |

RM3,000 |

|

|

Affinbank Visa Signature Card

|

RM150 |

15% p.a. |

Apply Now

|

Feature Highlights

- Why waste your time to key in the pin during payment? Tap your Affinbank Visa Signature Card to enjoy 3% cashback on contactless transactions.

- Enjoy 1x AFFIN Rewards Point for every RM1 PIN-based and “card-not-present” transaction spent (

- Receive payment terms from 6 to 36 months on any retail purchase. One-time interest rate starts from 2%.

Get 3% Cashback on every tap with Affinbank Visa Signature Card

- The special credit card from Affinbank will give you 3% cashback whenever you make contactless retail transactions, without minimum spending amount. To perform a contactless transaction with your Affinbank credit card, simply tap the credit card in front of the Visa payWave contactless reader. However, please be noted that there’s an RM80 monthly cap for the cashback and the feature isn’t valid for government services and charity transactions.

Fees and Charges

- For the first year, the card is free of charge. For the following years, there will be a RM150 charge. However, it can be waived when you spend minimum 12 times on retail transactions in a year while supplementary card holders will be charged RM100.

Are You Eligible For The Affinbank Visa Signature Card?

- Anybody can apply for the Affinbank Visa Signature Card with a minimum annual income of RM48,000. The individual must be at least 21 years old and above to hold a primary card and 18 years old above for a supplementary card.

Flexibility Fee and Charges

-

-

Annual Fee

RM150 for primary cards and RM100 for supplementary cards.

Cashback

-

Enjoy 3% cashback every time you perform a contactless transaction – simply tap your Affinbank Visa Signature Card during payment!

Points

-

For non-contactless transactions, enjoy 1x AFFIN Rewards Point for every RM1 PIN-based and “card-not-present” transaction spent (e-commerce, mail order phone, recurring & standing instruction).

Balance Transfer

-

Affin Bank Balance Transfer installment Plan offers low one-time upfront charges and payment terms up to 36 months. One-time interest is as low as 2%.

Card Information

-

-

-

Min. Monthly Income

RM4,000

-

Min. age for principal holder and supplementary holder

21 and 18 years old above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

2% one-time upfront handling fee |

RM500 |

| 12 months |

4% one-time upfront handling fee |

RM1,000 |

| 18 months |

5% one-time upfront handling fee |

RM2,000 |

| 24 months |

6% one-time upfront handling fee |

RM2,000 |

| 36 months |

7% one-time upfront handling fee |

RM3,000 |

|

|

AFFIN DUO Visa Cash Back Card

|

RM75 |

15% p.a. |

Apply Now

|

Feature Highlights

- Earn up to 3% cashback whenever you shop online, top up your e-Wallet and make an auto billing transaction.

- Enjoy 3 years annual fee waiver too!

- The more you spend, the more rewards points you can earn.

Get 3% cashback with AFFIN DUO Visa Cash Back

- With every Ringgit transacted on any e-commerce or online retail transaction using AFFIN DUO Visa Cash Back, you will earn 3% cashback equivalent to a maximum of RM80 per month credited into your account. The same goes when you spend on eWallet reload or transaction, as well as auto-billing such as online monthly subscriptions of Netflix, Spotify, etc with this card. However, do note that the cashback is not applicable for cash advance or withdrawal, charity related transactions and government services.

Fees and Charges

- All you need to pay is the Sales and Service Tax of RM25. For the first 3 years, the annual fee is waived but you still can enjoy the annual fee waiver for the subsequent year when you spend minimum 12 times on retail transactions in a year.

Are You Eligible For The AFFIN DUO Visa Cash Back Card?

- Anybody can apply for the AFFIN DUO Visa Cash Back Card with a minimum annual income of RM24,000. The individual must be at least 21 years old and above to hold a primary card and 18 years old above for a supplementary card.

Flexibility Fee and Charges

-

-

Annual Fee

RM75 for primary cards and RM30 for supplementary cards.

Cashback

-

Earn 3% cashback each time you shop on any e-commerce or online transactions, top up your e-Wallets and make auto-billing transactions of up to RM80 per month.

Balance Transfer

-

Consolidate all your outstanding balance into one manageable sum with Affin Bank Balance Transfer Instalment Plan and make full use of the low upfront interest rate charges you get.

Easy Payment Plans

-

Select your desired payment tenure from 6 months to as long as 36 months for your purchases with Affin Bank Easy Instalment Plan.

Card Information

-

-

-

Min. Monthly Income

RM2,000

-

Min. age for principal holder and supplementary holder

21 and 18 years old above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

2% one-time upfront handling fee |

RM500 |

| 12 months |

4% one-time upfront handling fee |

RM1,000 |

| 18 months |

5% one-time upfront handling fee |

RM2,000 |

| 24 months |

6% one-time upfront handling fee |

RM2,000 |

| 36 months |

7% one-time upfront handling fee |

RM3,000 |

|

|

AFFIN DUO Master Card Rewards

|

RM75 |

15% p.a. |

Apply Now

|

Feature Highlights

- Life gets more rewarding whenever you spend on dining and groceries with AFFIN Mastercard Rewards. Earn up to 3X AFFIN Rewards Points!

- With every RM1 transaction made on petrol fueling, earn up to 3X AFFIN Rewards Points.

- The more you spend, the more rewards points you can earn.

Up to 3X AFFIN Rewards Points

- So how can you earn the rewards points? It is as easy as pie! Every time you spend at least RM1 when you’re out dining with your friends or family using AFFIN DUO Mastercard Rewards credit card, you could earn 3X AFFIN Rewards Points. Even groceries shopping and petrol fueling could grant you 3X AFFIN Rewards Points too. The more you spend, the more rewards points you can collect.

Fees and Charges

- For the first 3 years, the AFFIN DUO Mastercard Rewards is free of charge. Once approved, all you need to pay is the Sales and Service Tax of RM25. On the subsequent year, the annual fee for Principal card is RM75 and RM30 for Supplementary card. Nonetheless, you still get to enjoy the annual fee waiver when you swipe minimum 12 times on retail transactions in a year.

Are You Eligible For The AFFIN DUO Master Card Rewards?

- Anybody can apply for the AFFIN DUO Master Card Rewards with a minimum annual income of RM24,000. The individual must be at least 21 years old and above to hold a primary card and 18 years old above for a supplementary card.

Flexibility Fee and Charges

-

-

Annual Fee

RM75 for primary cards and RM30 for supplementary cards.

Reward Points

-

Get 3X AFFIN Rewards Points for every RM1 transaction on dining, groceries shopping and petrol fueling. The more you spend, the more rewards points you can earn.

Petrol

-

With every RM1 transaction made on petrol fueling, earn up to 3X AFFIN Rewards Points.

Premium

-

Redeem merchandise(s), voucher(s), and/or airmiles points with AFFIN Rewards Points.

Card Information

-

-

-

Min. Monthly Income

RM2,000

-

Min. age for principal holder and supplementary holder

21 and 18 years old above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

2% one-time upfront handling fee |

RM500 |

| 12 months |

4% one-time upfront handling fee |

RM1,000 |

| 18 months |

5% one-time upfront handling fee |

RM2,000 |

| 24 months |

6% one-time upfront handling fee |

RM2,000 |

| 36 months |

7% one-time upfront handling fee |

RM3,000 |

|

|

Affinbank Master Card Gold

|

RM150 |

15% p.a. |

Apply Now

|

Feature Highlights

- Low interest rate MasterCard Gold credit card with no annual fee. Enjoy comprehensive line of credits as well as loyalty points on retail spending.

- Earn 1x AFFIN Rewards Points for every RM1 spent on retail purchases.

- Enjoy one-time charges from as low as 2% and payment terms up to 36 months.

Get Peace of Mind with Affin Credit Shield

- Youu have the option to sign up for Affin Credit Shield, a group term life plan insurance that covers you against Death and Total Permanent & Disability for up to RM300,000 each. This insurance plan pays the outstanding balance on your monthly statement of your credit card in case unfortunate things happen to you. For more information about this insurance, click here.

Fees and Charges

- Affinbank MasterCard Gold is free from annual fee for the first year. For the subsequent year, the annual fee is RM150 for the principal card and RM75 for each supplementary card. However, the annual fee for the subsequent years can be waived with a minimum spend of RM24,000 each year.

Are You Eligible For The Affinbank Master Card Gold?

- Anybody can apply for the Affinbank Master Card Gold with a minimum annual income of RM24,000. The individual must be at least 21 years old and above to hold a primary card and 18 years old above for a supplementary card.

Flexibility Fee and Charges

-

-

Annual Fee

RM150 will be charged for primary card and RM75 will be charged for supplementary card holders.

Entertainment

-

Like gifts and free stuff? Spend with your Affinbank MasterCard Gold on retail purchases as every RM1 spent will get you 1x AFFIN Rewards Points. Spend more to collect more points, which can be redeemed with gifts, vouchers and other merchandises!

Easy Payment Plans

-

Affin Bank EiPlan offers payment terms from 6 to 36 months on any retail purchase. The upfront interest rate starts from 2%.

Card Information

-

-

-

Min. Monthly Income

RM2,000

-

Min. age for principal holder and supplementary holder

21 and 18 years old above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

3% one-time upfront handling fee |

RM500 |

| 12 months |

4% one-time upfront handling fee |

RM1,000 |

| 18 months |

5% one-time upfront handling fee |

RM2,000 |

| 24 months |

6% one-time upfront handling fee |

RM2,000 |

| 36 months |

7% one-time upfront handling fee |

RM3,000 |

|

|

BSN Visa Cash Back Credit Card

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- Save up to 5% cashback every month as you spend on your daily necessities. What’s more, overseas spend are included too. No annual fees for life!

- Other retail spend can get you 0.2% unlimited cashback, while overseas spend earns you 1% unlimited cashback.

- Enjoy RM15 per month on petrol filling.

Complimentary Travel Insurance

- To add on, travel with peace of mind knowing that you and your loved ones are protected whilst on your way to wherever destination around the globe that you dreamed of. Getting this free travel insurance is easy. Every time you are about to check out, don’t forget to charge your full fare air ticket(s) to BSN Visa Cash Back Credit Card and up to RM300,000 complimentary travel insurance is granted to you.

Fees and Charges

- The annual fee is free for life without condition for both primary card holders and supplementary card holders. There will be a charge of RM25 on each principal and supplementary card upon activation and anniversary date as a Sales and Service Tax.

Are You Eligible For The BSN Visa Cash Back Credit Card?

- Anybody can apply for the BSN Visa Cash Back Credit Card with a minimum annual income of RM48,000. The individual must be at least 21 years old and above to hold a primary card and 18 years old above for a supplementary card.

Flexibility Fee and Charges

-

-

Annual Fee

Free for life without condition.

Cashback

-

Get up to 5% cashback when you shop for groceries, dine at your favourite restaurant and fill up your tank, capped at RM15 per month. Other retail spend can get you 0.2% unlimited cashback, while overseas spend earns you 1% unlimited cashback.

Petrol

-

Earn up to 5% cashback, capped at RM15 per month on petrol filling.

Travel

-

Get Platinum Protection with complimentary travel insurance of up to RM300,000 when you charge your full fare air ticket(s) to this card.

Card Information

-

-

-

Min. Monthly Income

RM2,000

-

Min. age for principal holder and supplementary holder

21 and 18 years old above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

3% one-time upfront handling fee |

RM500 |

| 12 months |

4% one-time upfront handling fee |

RM1,000 |

| 24 months |

5% one-time upfront handling fee |

RM2,000 |

|

|

UOB YOLO Visa

|

RM90 |

15% p.a. |

Apply Now

|

Feature Highlights

- Get up to 5% cashback on Online, Dining and Contactless categories, plus enjoy other exclusive discounts all year long.

- Enjoy low interest rates and flexible tenures up to 18 months when you transfer a minimum of RM1,000 credit card outstanding balance to UOB YOLO Visa.

- Receive 0% EPP on your overseas retail purchase with a minimum conversion amount of RM3,000!

Up to 5% Online, Dining, and Contactless Cashback

- With UOB YOLO Visa, you will not be going to miss out on the latest transportation, online and food trending anymore. You only need to make a minimum of 5 transactions on Online, Dining and Contactless categories combined to earn 5% cashback, capped at RM30 a month. But here’s the catch. For each transaction, you need to spend a minimum amount of RM15. On top of that, the total cashback payout is on a first come first serve basis only because the payout limit is capped at RM160,000 every month.

Fees and Charges

- RM90 will be charged for primary card holders. It is free during the first year for principal cardholder. The card can be waived when you make 1 retail transaction per month. While RM30 will be charged for supplementary card holders. There will also be a charge of RM25 on each principal and supplementary card upon activation and anniversary date as a Sales and Service Tax.

Are You Eligible For The UOB YOLO Visa Card?

- Anybody can apply for the UOB YOLO Visa Card with a minimum annual income of RM36,000. The individual must be at least 21 years old and above to hold a primary card and 18 years old above for supplementary card holders.

Flexibility Fee and Charges

-

-

Annual Fee

RM90 for primary card holders and RM30 for supplementary card holders.

Cashback

-

Perform at least 5 transactions on Online, Dining and Contactless categories in a month, with a minimum spend of RM15 on each category per transaction to earn 5% cashback, capped at RM30 per month (combined).

Balance Transfer

-

Enjoy low interest rates and flexible tenures up to 18 months when you transfer a minimum of RM1,000 credit card outstanding balance to UOB YOLO Visa.

Easy Payment Plans

-

Convert your purchases made at participating merchants with UOB Instalment Payment Plan to enjoy interest-free instalment for up to 36 months. Also, enjoy 0% EPP on your overseas retail purchase with a minimum conversion amount of RM3,000!

Card Information

-

-

-

Min. Monthly Income

RM3,000

-

Min. age for principal holder

21 and above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 12 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

| 18 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

| 24 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

| 36 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

|

|

UOB One Visa Classic Card

|

RM68 |

15% p.a. |

Apply Now

|

Feature Highlights

- Put money back into your pocket with the UOB ONE Visa Classic, a credit card that earns you up to 5% cashback for all of your everyday purchases.

- Earn up to 5% cash rebate every month on selected categories such as petrol, groceries, telecommunication and other eligible purchases.

- Apply for the UOB Balance Transfer with attractive interest rates from as low as 3% p.a.

0% Easy Payment Plan (EPP)

- Stop making window shopping a frequent pastime! In case you find merchandise which you can’t readily afford, UOB One Visa Classic offers 0% interest on monthly installments with Easi-Payment Plan. Just pick between tenures of 6, 12, or 18 months and pay a small upfront fee. To qualify, your purchase needs to be at least RM500 to enroll in this plan

Fees and Charges

- RM68 will be charged for primary card holders while RM30 will be charged for supplementary card holders. There will also be a charge of RM25 on each principal and supplementary card upon activation and anniversary date as a Sales and Service Tax.

Are You Eligible For The UOB One Visa Classic Card?

- Anybody can apply for the UOB One Visa Classic Card with a minimum annual income of RM24,000. The individual must be at least 21 years old and above to hold a primary card.

Flexibility Fee and Charges

-

-

Annual Fee

RM68 for primary card holders and RM30 for supplementary card holders.

Cashback

-

Up to 5% cash rebate every month on selected categories such as petrol, groceries, telecommunication and other eligible purchases.

Petrol

-

Protect yourself from fluctuating prices of RON95 and RON97 with UOB ONE Visa Classic credit card. Get 5% cashback on petrol, capped at RM200 per month, every weekend and 1% cashback every other day.

Premium

-

Are you a foodie? Then you can fully enjoy exclusive dining privileges at over 150 dining outlets nationwide at 15% discount with UOB ONE Visa Classic.

Card Information

-

-

-

Min. Monthly Income

RM2,000

-

Min. age for principal holder

21 and above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 12 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

| 18 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

| 24 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

| 36 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

|

|

UOB Visa Basic Card

|

RM72 |

15% p.a. |

Apply Now

|

Feature Highlights

- A basic Visa credit card that fulfilled your needs and is packed with affordable and flexible credit lines, and fee waiver every month upon transaction.

- Enjoy Fee Waiver on monthly fee of RM6 for every retail transaction made in a statement month. No minimum spend is required!

- Get up to 0% interest on 3-month Overseas Easi-Payment Plan with a minimum conversion of RM3,000.

Annual Fee Waiver

- UOB Basic Visa Card has a monthly fee of RM6.00, which can be waived when you make one retail transaction (no minimum amount) in a statement month. Bear in mind that the Sales & Service Tax of RM25 will be charged upon the anniversary date of your credit card. For supplementary cardholders, the annual fee is at RM30.

Fees and Charges

- RM75 will be charged for primary card holders. The card can be waived when you made 1 retail transaction every month while RM30 will be charged for supplementary card holders.

Are You Eligible For The UOB Visa Basic Card?

- Anybody can apply for the UOB Visa Basic Card with a minimum annual income of RM24,000. The individual must be at least 21 years old and above to hold a primary card.

Flexibility Fee and Charges

Premium

-

Enjoy Fee Waiver on monthly fee of RM6 for every retail transaction made in a statement month. No minimum spend is required!

Easy Payment Plans

-

Convert your purchases made at merchants with UOB flexi payment plan to enjoy interest rate from as low as 0% for up to 36 months. Enjoy 0% interest on 3-month Overseas Easi-Payment Plan with a minimum conversion of RM3,000.

UOB Instalment Payment Plan

-

Shop your desired items with UOB 0% Instalment Payment Plan when you shop at any UOB 0% IPP merchant outlets!

Card Information

-

-

-

Min. Monthly Income

RM2,000

-

Min. age for principal holder

21 and above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 12 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

| 18 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

| 24 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

| 36 months |

0% p.a. and no one-time upfront handling fee |

RM1,000 |

|

|

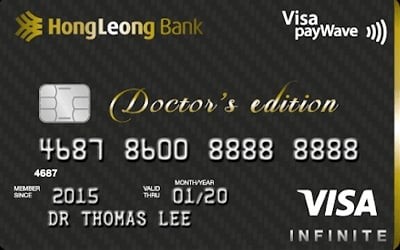

Hong Leong Visa Infinite Doctor’s Edition Card

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- Hong Leong Visa Infinite Doctor’s Edition is designed for medical doctors & dentists to make their lives merrier. No annual fee & superb enrich miles conversion!

- Earn 1 MAS Enrich Miles for every RM2.80 local or RM1.80 overseas retail spend.

- Enjoy 4x complimentary access to Plaza Premium Airport Lounges in Malaysia and Singapore!

Hong Leong Visa Infinite Doctor’s Edition, every doctor’s best friend

- Your best friend would want only the best things to happen to you, so does Hong Leong Visa Infinite Doctor’s Edition. This Hong Leong credit card is specially designed to reward medical doctors and dentists so they can enjoy their lives as they have saved many people’s lives. From superb Enrich Miles conversion, free travel insurance, zero annual fees to Visa Digital Concierge – it’s time for doctors to enjoy the best life can offer.

Fees and Charges

- It is free for life for both primary and supplementary card holders. There will be a RM25 charge on each principal and supplementary card upon activation and anniversary date as a Sales and Service Tax.

Are You Eligible For The Hong Leong Visa Infinite Doctor’s Edition Card?

- Only registered medical doctors and dentists can apply for the Hong Leong Visa Infinite Doctor’s Edition Card with a minimum annual income of RM48,000. The individual must be between 21 to 70 years old and above to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Enrich Miles

-

Earn 1 MAS Enrich Miles for every RM2.80 local or RM1.80 overseas retail spend. Collect as much air miles you need to bump into the first class cabin as there is no expiry date for this reward points.

Travel

-

Doctors, enjoy 4x complimentary access to Plaza Premium Airport Lounges in Malaysia and Singapore! Your travel insurance for up to RM3 million is covered by the bank.

Premium

-

Your personalised “doctor-on-call” service via Visa Digital Concierge for all your travel and lifestyle demands, anytime and anywhere in the world.

Card Information

-

-

-

Min. Monthly Income

M4,000

-

Min. age for principal holder

21 to 70 years old

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

Free

|

|

Hong Leong Emirates HLB Platinum Card

|

RM250 |

15% p.a. |

Apply Now

|

Feature Highlights

- Free flight tickets isn’t a dream. Collect Skywards Miles on every transaction, plus extra 2,500 miles each as Welcome Bonus and Anniversary Bonus!

- Exclusively for Hong Leong Emirates HLB Platinum cardholders, Flexi Payment Plan (FPP) offers an installment period of 12 months at 0% p.a with min. retail spend of RM1,000.

Complimentary Airport Transfer & Golf Privileges

- With a minimum spend of RM2,000 on Emirates or overseas purchases, you’re entitled to 1x Grab ride worth RM88 that you can use as airport transfer. Not traveling soon? Why not try a new hobby, like golf? Hong Leong Emirates Platinum Card lets you enjoy 1x Green Fee per month at selected Golf Clubs in Malaysia, with a minimum balance of RM2,000 in preceding month statement.

Fees and Charges

- RM250 will be charged for primary card holders. The card can be waived when you spend a minimum of RM50,000 per year whereas supplementary card is free.

Are You Eligible For The Hong Leong Emirates HLB Platinum Card?

- Anybody can apply for the Hong Leong Emirates HLB Platinum Card with a minimum annual income of RM60,000. The individual must be between 21 to 65 years old and above to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Skywards Miles

-

Earn 2,500 Skywards Miles as Welcome Bonus for your first retail transaction (within 45 days from the card approval date) and 2,500 Skywards Miles as Anniversary Bonus when you spend RM50,000 within the card anniversary.

Complimentary Airport Transfer & Golf Privileges

-

With a minimum spend of RM2,000 on Emirates or overseas purchases, you’re entitled to 1x Grab ride worth RM88 that you can use as airport transfer. Not traveling soon? Why not try a new hobby, like golf? Hong Leong Emirates Platinum Card lets you enjoy 1x Green Fee per month at selected Golf Clubs in Malaysia, with a minimum balance of RM2,000 in preceding month statement.

Premium

-

Free 1x green fee/month at selected golf clubs in Malaysia and travel & lifestyle services.

Card Information

-

-

-

Min. Monthly Income

M5,000

-

Min. age for principal holder

21 to 65 years old

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

Free

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

| 8.99% p.a. and no one-time upfront handling fee |

|

RM500 |

| 12 months |

| 8.99% p.a. and no one-time upfront handling fee |

|

RM1,000 |

| 18 months |

| 8.99% p.a. and no one-time upfront handling fee |

|

RM1,000 |

|

|

Hong Leong AirAsia Gold Visa Card

|

RM200 |

15% p.a. |

Apply Now

|

Feature Highlights

- Fly to your favorite destination with Hong Leong AirAsia card where you can earn up to 1X BIG Points for AirAsia flight bookings and daily spends!

- Earn 1 BIG Point for every RM2 overseas spend and RM5 local spend.

Annual Fee Waiver

- In addition to the Welcome BIG Points, your first year annual fee will be waived! Just make sure that you have a minimum 1 retail swipe within 45 days from your Hong Leong AirAsia Gold Visa approval date.

Fees and Charges

- RM200 will be charged for primary card holders. The card can be waived when 1 swipe was made within 45 days of card approval for the first year whereas RM80 will be charged for supplementary card holders.

Are You Eligible For The Hong Leong AirAsia Gold Visa Card?

- Anybody can apply for the Hong Leong AirAsia Gold Visa Card with a minimum annual income of RM24,000. The individual must be between 21 to 65 years old and above to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Travel

-

Earn 1 BIG Point for every RM1 AirAsia flight booking spend.

Premium

-

Enjoy 3,000 Welcome BIG Points when you spend min. RM1,500 within 60 days of the card approval and extra 3,000 BIG Points when you spend min. RM3,000 per calendar quarter.

Balance Transfer

- Hong Leong offer balance transfers from as low as 6.99% on 6 and 12 months payment plan.

Card Information

-

-

-

Min. Monthly Income

M2,000

-

Min. age for principal holder

21 to 65 years old

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

RM80

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

| 8.99% p.a. and no one-time upfront handling fee |

|

RM500 |

| 12 months |

| 8.99% p.a. and no one-time upfront handling fee |

|

RM1,000 |

| 18 months |

| 8.99% p.a. and no one-time upfront handling fee |

|

RM1,000 |

|

|

Hong Leong Visa Infinite P Card

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- Only for the very exclusive. Enjoy getting pampered at Priority Pass airports lounges worldwide to escape from the busy departure hall crowd.

- Earn 4x access to Priority Pass airport lounges worldwide.

- Spend RM2.80 locally or RM1.80 overseas to receive 1 MAS Enrich Miles point.

Worldwide Lounge Access

- With Hong Leong Visa Infinite P, you can escape the hustle and bustle of the busy airport. Just block your time for an airport lounge visit as a part of your travel itinerary with Priority Pass, the world’s premier independent airport lounge access program. The principal cardholders will be rewarded with 4 visits to any airport lounge listed under the Priority Pass program. You will be given 4 complimentary lounges visit for the subsequent years if you spend a minimum of RM300,000 retail purchases in the preceding year.

Fees and Charges

- The annual fee is free for life for both primary and supplementary card holders. There will be an RM25 charge for Sales And Service Tax on each principal and supplementary card upon activation and anniversary date

Are You Eligible For The Hong Leong Visa Infinite P Card?

- Anybody can apply for the Hong Leong Visa Infinite P Card. The individual must be at least 21 and above to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Enrich Miles

- Get Malaysian Airlines Enrich Miles for every retail spend charged to this Visa Infinite P credit card. Spend RM2.80 locally or RM1.80 overseas, you will receive 1 MAS Enrich Miles point, which is non-expiry!

Travel

-

You will have complimentary 4x access to Priority Pass airport lounges worldwide, comprehensive travel insurance plus benefits, and Visa Infinite Concierge Services to help you with any bookings or reservations at any time of the day.

Premium

-

Enjoy preferential foreign currency exchange rate at domestic airports, and 24-Hour Hong Leong Premium Card Services Line to assist you at anytime, anywhere.

Card Information

-

-

-

Min. Monthly Income

Not Applicable

-

Min. age for principal holder

21 and above

-

Min. age for supplementary holder

18 and above

-

Annual Fee for supplementary holder

Free

|

|

Hong Leong Sutera Platinum Card

|

RM400 |

15% p.a. |

Apply Now

|

Feature Highlights

- Earn Reward Points every time you spend locally and overseas.

- Plus get free access to Plaza Premium Lounge and travel insurance coverage of up to RM1.7 million.

- Earn up to 6x rewards points for retail spending, travel and dining.

A faster way to earn rewards points

- With the new Hong Leong Sutera Platinum Card, you can turn your spending into reward points up to 6x faster than most other rewards points cards. Earn 6x rewards points every RM1 spent overseas, 3x for dining at any day of the week, 3x for local spending on weekends, and 1x for everything else.

Fees and Charges

- RM400 will be charged for primary card holders. The card can be waived when 1 swipe was made within 45 days of card approval for the first year or when you spend at least RM15,000 a year for subsequent years whereas RM200 will be charged for supplementary card holders.

Are You Eligible For The Hong Leong Sutera Platinum Card?

- Anybody can apply for the Hong Leong Sutera Platinum Card. The individual must be between 21 to 65 years old and above to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Travel

- Complimentary unlimited Plaza Premium Lounge access to KLIA and klia2 for the first 250 card holders each month. What’s more – you can enjoy travel insurance coverage of up to RM1.7 million.

Premium

-

24 hours, 7 days a week Visa Platinum Concierge Service is available for information such as concert bookings, dinner reservations and more.

Hong Leong Points

- All your accumulated Hong Leong Sutera Platinum Card reward points can turn into worthy redemption for a wide range of products such as home decorations, personal care, fashion, gadgets, travel accessories, vouchers and more. In addition to that, you can exchange the reward points with air miles such as Enrich Miles with 10000 points.

Card Information

-

-

-

Min. Monthly Income

RM5,000

-

Min. age for principal holder

21 to 65 years old

-

Min. age for supplementary holder

18 and above

-

Annual Fee for supplementary holder

RM200

|

|

Hong Leong I’m Card

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- Got a motivational quote you live and breathe by? Have it printed on your card! Enjoy zero annual fees with seamless 24- hour online banking.

- Enjoy 0 conversion markup when you exchange foreign currencies while travelling.

- Stretch your payments on all your shopping at 0% for up to 36 months.

Annual Fee Waiver

- Never pay for unnecessary annual fees every again – there’s no catch, you don’t have to pay a fee! However, there’s a joining fee that you’d need to take care of. The joining fee of RM20 is a one-time fee you pay once you’ve been approved for the Hong Leong Bank I’m Card, and is subjected to 6% GST.

Fees and Charges

- Annual Fee is free for life for both primary and supplementary card holders! Sales and Service Tax will be charged with RM25 on each principal and supplementary card upon activation and anniversary date.

Are You Eligible For The Hong Leong I’m Card?

- Anybody can apply for the Hong Leong I’m Card with a minimum annual income of RM24,000. The individual must be between 21 years old to 65 years old to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

0% Extended Payment Plan (EPP)

- They say patience is a virtue – but what if you just have to buy that shiny new laptop like right now? Even if you don’t have the cash to pay for it, you can certainly bring it home with Hong Leong Bank’s flexible 0% interest installment plan of up to 12 months.

Balance Transfer

- Consolidate your credit card oustanding balance to a low interest Hong Leong Bank credit card and enjoy 6.99% p.a. for 6 or 12 months.

Easy Payment Plans

- Get what you want, when you want it! Stretch your payments on all your shopping at 0% for up to 36 months, subject to participating merchants. For all the other purchases, you can go for the Hong Leong Flexi Payment Plan with interest rate at 8.99% p.a.. Need over a year to pay for that new luxury bag? Sure thing!

Card Information

-

-

-

Min. Monthly Income

RM2,000

-

Min. age for principal holder

21 to 65 years old

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

Free

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

8.99% and no one-time upfront handling fee |

RM500 |

| 12 months |

8.99% and no one-time upfront handling fee |

RM1,000 |

| 18 months |

8.99% and no one-time upfront handling fee |

RM1,000 |

|

|

OCBC Master Card Blue

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- Feel the steely confidence of the OCBC Master Card Blue. Uncapped up to 1% cash rebate on all your retail spending and an annual fee that’s waived for life.

- Receive unlimited1% cash rebate on your online transaction and overseas spending

- Enjoy 0.1% cash rebate on all other retail spending. The cash will be credited into your card account every month.

Great Financial Manager

- The OCBC PayMaster is an auto-debit system, giving you the convenience of having all your monthly service and utility bills paid directly via your OCBC MasterCard Blue. When you make a retail purchase either for a brand new laptop or sound system, you will enjoy a 20-day interest-free payment period. Additionally, spend at participating outlets with easy installment plans at 0% interest.

Fees and Charges

- Annual Fee is free for life for both primary and supplementary card holders! Sales and Service Tax will be charged with RM25 on each principal and supplementary card upon activation and anniversary date.

Are You Eligible For The OCBC Master Card Blue?

- Anybody can apply for the OCBC Master Card Blue with a minimum annual income of RM36,000. The individual must be at least 21 years old and above to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Cashback

- Receive unlimited 1% cashback everyday for all your online transaction and overseas spending. Also, the cash rebate on all other retail spending is 0.1%. Amount will be credited into your card account every month.

Balance Transfer

- Stop wasting your hard-earned cash on interest payments! Transfer your credit card debts to your OCBC credit card at a low 1.88%. Your outstanding balance needs to be at least RM1,000.

Easy Payment Plans

- Own what you want, when you want! Enjoy upfront interest as low as 4% with OCBC Easy Payment Instalment Plan. Split your repayments over 5, 10, or 20 months. Just call OCBC within 15 days of purchase!

Card Information

-

-

-

Min. Monthly Income

RM3,000

-

Min. age for principal holder

21 and above

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

Free

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 5 months |

4% one-time upfront handling fee |

RM1,000 |

| 10 months |

6% one-time upfront handling fee |

RM1,000 |

| 20 months |

7% one-time upfront handling fee |

RM1,000 |

|

|

OCBC Master Card Pink

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- Explore the sweeter side of life with OCBC MasterCard Pink. No annual fee ever and up to 1% unlimited cashback on your retail spending, anytime, anywhere.

- Receive uncapped 1% cash rebate on your online transaction and overseas spending

- Enjoy 0.1% cash rebate on all other retail spending. The cash will be credited into your card account every month.

Personal Financial Planner

- If you’ve just gotten your first full-time job, and have been entrusted with the responsibility of moving out of your parents’ house, what better way to manage your finances than by using a line of credit? You don’t have to take time off your busy schedule to personally make bill and cheque payments, so let your OCBC credit card do that for you. With the OCBC PayMaster auto-debit system, have all your monthly bills and loan repayments paid automatically. Saves you both the time and hassle. Thankfully, OCBC will provide you the luxury to convert your RM3,000 designer bag into interest free monthly installments for up to 20 months, on top of having a 20-day interest free period from the day of purchase.

Fees and Charges

- Annual Fee is free for life for both primary and supplementary card holders! Sales and Service Tax will be charged with RM25 on each principal and supplementary card upon activation and anniversary date.

Are You Eligible For The OCBC Master Card Pink?

- Anybody can apply for the OCBC Master Card Pink with a minimum annual income of RM36,000. The individual must be at least 21 years old and above to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Cashback

- No matter if you’re making payments locally or abroad, you will receive uncapped 1% cash rebate on your online transaction and overseas spending as well as 0.1% cash rebate on all other retail spending. The cash will be credited into your card account every month.

Balance Transfer

- For as low as 1.88% p.a., you can transfer your credit card debt from other banks’ credit card to your brand new OCBC card. Your outstanding balance needs to be at least RM1,000.

Easy Payment Plans

- OCBC Easy Instalment Plan – Convert your big purchases into smaller easy instalments over 5, 10, or 20 months. Call OCBC within 15 days of purchase to enjoy interest free monthly instalments.

Card Information

-

-

-

Min. Monthly Income

RM3,000

-

Min. age for principal holder

21 and above

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

Free

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 5 months |

4% one-time upfront handling fee |

RM1,000 |

| 10 months |

6% one-time upfront handling fee |

RM1,000 |

| 20 months |

7% one-time upfront handling fee |

RM1,000 |

|

|

OCBC Cashflo MasterCard

|

RM188 |

15% p.a. |

Apply Now

|

Feature Highlights

- Enjoy annual fee waiver for first 3 years and let it converts your shopping expenses into a 0% installment plan.

- Earn 0.5% unlimited cash rebate on your total retail spending with OCBC Cashflo MasterCard, no minimum spending is required!

- Convert a minimum of RM500 into a 0% Auto-IPP (Installment Payment Plan) to enjoy low and affordable monthly installment up to 12 months.

0% Auto-IPP

- So…you have purchased a big-ticket item but do not have enough cash to repay your credit card. What’s more, the 20-day interest free period is almost running out! Don’t fret as OCBC Cashflo MasterCard is equipped with a 0% Auto-IPP (Installment Payment Plan) with minimum spending of RM500. You can select to repay your outstanding balance in 3, 6 or 12-month installments; the longer the tenure, the smaller the installment amount.

Fees and Charges

- RM188 will be charged for primary card holders. It will be free during the first 3 years for new customers and those who don’t own any OCBC card for 12 months whereas RM68 will be charged for supplementary card holders.

Are You Eligible For The OCBC Cashflo Master Card?

- Anybody can apply for the OCBC Cashflo Master Card. The individual must be at least 21 years old and above to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Cashback

- Earn 0.5% unlimited cash rebate on your total retail spending with OCBC Cashflo MasterCard, no minimum spending is required!

Travel

- Travel the world with peace of mind. Just reach out to OCBC 24-hour concierge at 1800-80-6429 to take advantage of a personalized service that answers all your travel queries.

Auto Bill Payment

- Simplify all your service and utility bill payments via OCBC PayMaster for more convenience. All you have to do is register your OCBC Cashflo MasterCard as a primary payment tool and let your credit card does all your bill payment on time via auto debit.

Card Information

-

-

-

Min. Monthly Income

RM3,000

-

Min. age for principal holder

21 and above

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

RM68

|

|

OCBC Premier Voyage Master Card

|

RM750 |

15% p.a. |

Apply Now

|

Feature Highlights

- OCBC Premier Voyage is made of Duralumin, strong but a lightweight alloy of alluminium. Enjoy range of personalised concierge services with a luxury touch!

- Be rewarded with 1 Voyage Miles for every RM5 spent locally or overseas.

- Voyage Miles never expire so collect and exchange them for free flights whenever you want, on the airline of your choice and to any destination!

Travel Easy

- Don’t fret when you receive your credit card statement, enjoy the long vacations and business trips knowing that you can always stretch your payments from periods of 5 months with the low handling fee of 2% once-off with OCBC Easy Payment Plan. Swipe your ticket with your credit card and contact OCBC to enroll in the plan. If that’s too short a period, relax, you could even go up to 20 months with the one-time upfront interest rate at only 5% when you spend RM1000.

Fees and Charges

- RM750 will be charged for primary card holders whereas RM500 will be charged for supplementary card holders.

Are You Eligible For The OCBC Premier Voyage Master Card?

- Only OCBC Premier Banking members can apply for the OCBC Premier Voyage Master Card. The individual must be at least 21 years old and above to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Voyage Miles

- Make every Ringgit spent count! For each RM5 spent locally or overseas, you will be rewarded with 1 Voyage Miles. These Voyage Miles never expire so collect and exchange them for free flights whenever you want, on the airline of your choice and to any destination!

Travel

- Relax and unwind at KLIA Flight Club at absolute no cost! Simply present your card at the counter and walk in to world-class lounge facilities that include free flow of beverages, Chef’s choice of food and international TV channels. Travel with peace of mind knowing that OCBC has got you covered with free travel insurance up to USD 1 million of coverage!

Premium

- Don’t crack your head no more with trip planning or table booking. OCBC world class concierge service is only a call away to provide you with personalised services from end-to-end travel planning to restaurants and concerts reservation to grocery shopping!

Card Information

-

-

-

Min. Monthly Income

Not Applicable

-

Min. age for principal holder

21 and above

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

RM500

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 5 months |

4% one-time upfront handling fee |

RM1,000 |

| 10 months |

6% one-time upfront handling fee |

RM1,000 |

| 20 months |

7% one-time upfront handling fee |

RM1,000 |

|

|

Maybank GRAB Mastercard Platinum

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- Always on the go? Maybank GRAB Mastercard Platinum works hard in rewarding you with an abundant of Grab Rewards and vouchers for your daily spends.

- Get 1x Maybank Grab Point for every RM3 spend on any other local purchase.

- 5x GrabRide and GrabFood Vouchers worth RM5 each when you spend at least RM300 in the Grab app

Enjoy Special Promotions with Your Maybank Grab Master Card Platinum

- Earn 5x Maybank Grab Points for every RM1 spend in the Grab app (including Grab e-wallet reload), 2x Maybank Grab Points for every RM1 spend on e-commerce and overseas purchases and 1x Maybank Grab Point for every RM3 spend on any other local purchase.

Fees and Charges

- You need not to pay for the annual fee to renew your principal and/or supplementary card as it is free for life! Sales And Service TaxRM25 on each principal and supplementary card upon activation and anniversary date with a Minimum Monthly Payment of RM25 or 5% of outstanding amount, whichever is higher.

Are You Eligible For The Maybank Grab Master Card Platinum?

- Only Malaysians can apply for the Maybank Grab Master Card Platinum with a minimum annual income of RM36,000. The individual must be between 21 years old to 65 years old to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Premium

- Get rewarded with 1,000 Maybank Grab Points as a Welcome Gift, 5x GrabRide and GrabFood Vouchers worth RM5 each when you spend at least RM300 in the Grab app within 45 days from the card approval date. Enjoy great benefits of Grab Platinum tier for 6 months upon card activation.

Balance Transfer

- Maybank Balance Transfer Program offers interest rates as low as 0% and payment terms up to 36 months with a minimum transfer amount starting from RM1,000.

Easy Payment Plans

- Maybank EzyPay offers interest-free shopping with a payment period of up to 24 months at approved merchants. For all other purchases, you can opt for Maybank EzyPay Plus for low rate instalments of up to 24 months.

Card Information

-

-

-

Min. Monthly Income

RM3,000.00

-

Min. age for principal holder

21 to 65 years old

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

Free

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 3 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

| 6 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

| 12 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

| 18 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

| 24 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

| 36 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

|

|

Maybank Shopee Visa Platinum Card

|

RM88.00 |

15% p.a. |

Apply Now

|

Feature Highlights

- Earn up to 5x Shopee Coins on Shopee. dining, entertainment and contactless transactions every 28th of each month.

- Normal calendar days will give you up to 2x Shopee Coins.

Enjoy Special Promotions with Your Maybank Shopee Card

- As a Maybank Shopee cardholder, you can also enjoy special promotions, such as receiving a 50% off (capped at RM50) without a minimum spend for Anello, P&G, Arctic Hunter, Enfragrow A+, Tefal and realme products on Shopee App as well as a 1-For-1 Seasonal Beverages at San Fransisco Coffee outlets

Fees and Charges

- You need not to pay for the annual fee to renew your principal and/or supplementary card as it is free for life! Sales And Service TaxRM25 on each principal and supplementary card upon activation and anniversary date with a Minimum Monthly Payment of RM25 or 5% of outstanding amount, whichever is higher.

Are You Eligible For The Maybank Shopee Visa Platinum Card?

- Anybody can apply for the Maybank Shopee Visa Platinum Card with a minimum annual income of RM36,000. The individual must be between 21 years old to 65 years old to hold a primary card. Supplementary card applicants must be age 18 and above.

Flexibility Fee and Charges

Shopee Coins

- Enjoy up to 5x Shopee Coins for Shopee, dining, payWave, entertainment and other spend every 28th of each month, 9.9, 11.11, 12.12, CNY and Raya Campaigns (special days). Normal calendar days will give you up to 2x Shopee Coins.

Premium

- Get 5,000 Shopee Coins as Welcome Gift upon your card activation and when you spend a min. of RM300 on accumulation purchases in the first 2 months.

Maybankard EzyCash

- Instant cash at 0% interest with minimum loan amount of RM2,000. Refurbish your home, pay for your insurance or simply pay your outstanding bills.

Card Information

-

-

-

Min. Monthly Income

RM3,000.00

-

Min. age for principal holder

21 to 65 years old

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

Free

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 3 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

| 6 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

| 12 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

| 18 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

| 24 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

| 36 months |

0% p.a. and no one-time upfront handling fee |

RM50 |

|

|

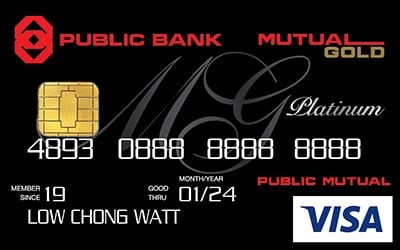

Mutual Gold Public Bank Visa Platinum

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- Exclusively for Mutual Gold and Mutual Gold Elite Members of Public Mutual.

- Get 30% cashback when you spend minimum RM100 on contactless transactions (Visa PayWave)

- Enjoy 0.2% on all local and overseas retail purchases, plus 0.3% Mutual Gold Cash Bonus on your birthday month.

Full Travel Insurance

- Get a complimentary travel insurance coverage worth up to RM500,000, including compensation for travel inconveniences such as delayed flight or missed flight, and delayed luggage or lost luggage. Just charge your travel arrangement to Mutual Gold Visa Platinum credit card to qualify.

Fees and Charges

- Free for life for both primary and supplementary card holders. Waived when as long as the Mutual Gold/Mutual Gold Elite/Mutual Platinum status is maintained with Public Mutual Berhad.

Are You Eligible For The Mutual Gold Public Bank Visa Platinum Card.

- Only those who are invited can apply for the Mutual Gold Public Bank Visa Platinum Card. The individual must be aged 21 years old and above to apply as a principal card holder and 18 years old and above for supplementary card holders.

Flexibility Fee and Charges

Cashback

- Unlimited Cash MegaBonus of 0.2% on all local and overseas retail purchases, plus 0.3% Mutual Gold Cash Bonus on your birthday month. Until 30 September 2021, get 30% cashback when you spend minimum RM100 on contactless transactions (Visa PayWave). Kindly SMS to participate “PBPW<space>16-digit Principal PB Visa Credit Card number to 66300”. Transactions such as auto-debits, utilities, insurance premiums, government and charity-related payments are not included for this cashback. Terms and conditions apply.

Travel

- Platinum Help Desk at ready for 24/7 for you. In addition, get free Travel Insurance coverage worth up to RM500,000 when you charged full travel tickets to your Public Bank credit card.

Premium

- 2x complimentary access to Plaza Premium Lounge in a year for Mutual Gold Elite and Mutual Platinum members.

Card Information

-

-

-

-

-

Min. Monthly Income

Non Applicable

-

Min. age for principal holder and supplementary holder

21 and 18 years above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU TRANSFER |

| 6 months |

0% p.a. and 1.5% one-time upfront handling fee |

from RM1,000 |

| 12 months |

0% p.a. and 3% one-time upfront handling fee |

from RM2,000 |

| 24 months |

0% p.a. and 5.5% one-time upfront handling fee |

from RM3,000 |

| 36 months |

0% p.a. and 7% one-time upfront handling fee |

from RM6,000 |

|

|

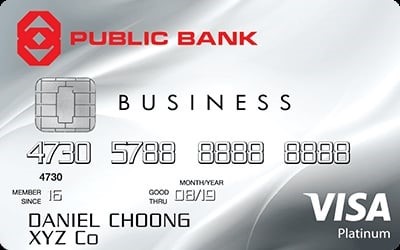

Public Bank Visa Business Card

|

RM150 |

18% p.a. |

Apply Now

|

Feature Highlights

- Take charge of your business with Public Bank Visa Business and provide your employees with a secure line of credit and concentrate on growing your business.

- Earn cashback on everything! 0.50% for all kinds of company spending.

- Enjoy 1.5% interest for a 6-month tenure with a minimum amount of transfer at RM1,000.

FREE insurance

- Public Bank understands that running a business involves a lot of risks, therefore it is important to have a backup plan that a company can remunerate for losses. With two complimentary insurance coverages: corporate liability waiver of up to USD1.65 Million and travel insurance with a maximum of RM1 Million per cardmember per annum, your company not only be saving on additional insurance expenses, but also get protected from any untoward incidences.

Fees and Charges

- It is RM150 for primary card holders with the first year being free of charge. The card can be waived once it reaches 12 swipes per year.

Are You Eligible For The Public Bank Visa Business Card.

- Any business can apply for the Public Bank Visa Business Card if the business is 21 years old and above.

Flexibility Fee and Charges

Travel

- Meet your clients where ever they are and have peace of mind with up to RM1,000,000 in complimentary Travel Insurance from Public Bank.

Premium

- Have full control of your company spending habits with the ability to set strict parameters and limit for your employees, when using this card.

Balance Transfer

- Have outstanding balance? Consolidate them with a balance transfer and enjoy 1.5% interest for a 6-month tenure. The minimum amount for transfer is RM1,000.

Card Information

-

-

-

Min. Monthly Income

Non Applicable

-

Min. age for principal holder

21 and above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

1.5% one-time upfront handling fee |

RM1,000 |

| 9 months |

2% one-time upfront handling fee |

RM2,000 |

| 12 months |

3% one-time upfront handling fee |

RM1,000 |

| 24 months |

5.5% one-time upfront handling fee |

RM2,000 |

| 36 months |

7% one-time upfront handling fee |

RM3,000 |

| 48 months |

9.5% one-time upfront handling fee |

RM5,000 |

|

|

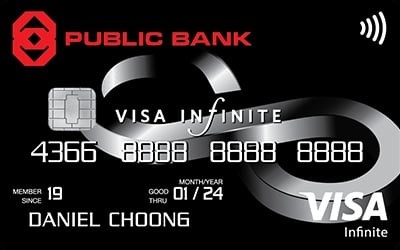

Public Bank Visa Infinite

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- No annual fee for life premium credit card offering Cash MegaBonus with every spending.

- Free travel insurance and 3x free airport lounge access.

- We give our customers countless of travel benefits from free lounge to airport dining.

Cashback

- Get 2% Cash MegaBonus on every retail item spend outside of Malaysia. Earn 0.3% Cash MegaBonus on all retail purchases made locally. Until 30 September 2021, get 30% cashback when you spend minimum RM100 on contactless transactions (Visa PayWave). Kindly SMS to participate “PBPW<space>16-digit Principal PB Visa Credit Card number to 66300”. Transactions such as auto-debits, utilities, insurance premiums, government and charity-related payments are not included for this cashback. Terms and conditions apply.

Fees and Charges

- It is free for life for both primary and supplementary card holders.

Are You Eligible For The Public Bank Visa Infinite Card.

- Anybody can apply for the Public Bank Visa Infinite Card if you are earning a minimum annual income of RM100,000 and is 21 years old and above to apply as principal card holder and to be at least 18 years old for holding a supplementary card.

Flexibility Fee and Charges

Travel

- 3x complimentary access to Plaza Premium Lounges in Malaysia in a year and free travel insurance coverage including claim for travel inconveniences worth up to RM500,000 when you charge your flight tickets to Visa Infinite credit card.

Premium

- Get 50% discount on Will and Wasiat Writing service fee at PB Trustee Services Berhad. Get covered with e-Commerce Purchase Protection programme of up to USD1,000 per claim every year when you make online purchases, subject to terms and conditions.

Balance Transfer

- Take advantage of savings and flexibility when you transfer your outstanding credit card debts to Public Bank credit card to benefit from low one-time upfront interest starting from 1.5%.

Card Information

-

-

-

Min. Monthly Income

RM8,333.33

-

Min. age for principal holder

21 and above

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

Free.

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 3 months |

0% p.a. and no one-time upfront handling fee |

RM500 |

| 6 months |

0% p.a. and no one-time upfront handling fee |

RM500 |

| 9 months |

0% p.a. and no one-time upfront handling fee |

RM500 |

| 12 months |

0% p.a. and no one-time upfront handling fee |

RM500 |

| 18 months |

0% p.a. and no one-time upfront handling fee |

RM500 |

| 24 months |

0% p.a. and no one-time upfront handling fee |

RM500 |

|

|

Public Bank Quantum Master Card

|

Free |

15% p.a. |

Apply Now

|

Feature Highlights

- Have no annuals fee for life.

- 5% cashbacks on online transactions capped at RM30 per month.

- Earn up to 2x VIP Points for overseas retail spend.

Cashback

- Don’t forget to use your Quantum MasterCard when you shop online as you can get 5% cashback, capped at RM30 per month.

Fees and Charges

- It is free for life for both primary and supplementary card holders.

Are You Eligible For The Public Bank Quantum Master Card.

- Anybody can apply for the Public Bank Quantum Master Card if you are earning a minimum annual income of RM36,000 and is 21 years old and above to apply as principal card holder and to be at least 18 years old for holding a supplementary card.

Flexibility Fee and Charges

Double Quantum Cards

- More good news for those wishing to sign up for Public Bank Quantum MasterCard today as you will get a complimentary Public Bank Quantum Visa credit card upon approval. Isn’t two is better than one?

5% Cashback

- Do you like the idea of getting back your money after spending it? Well, Public Bank Quantum MasterCard credit card gives you 5% cashback on every online transaction. Do you know that you can enjoy significant savings on your spending through cash rebate, which is sort of a refund in small percentage credited back into your credit card? All you need to do is spend, spend and spend! If Online Shopping is your biggest forte, then Public Bank Quantum MasterCard is the right choice for these indulgences. For every Ringgit spent on the category, you earn 5% cashback, capped at RM30 per month.

Premium

- Get a complimentary Public Bank Quantum Visa credit card when you sign up for this credit card – because two is better than one! Love shopping? Get your goods protected with e-Commerce Purchase Protection of up to USD200. Enjoy 50% discount on Will and Wasiat Writing service fee.

Card Information

-

-

-

Min. Monthly Income

RM3,000

-

Min. age for principal holder

21 and above

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

Free for life.

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

1.5% one-time upfront handling fee |

RM1,000 |

| 9 months |

2% one-time upfront handling fee |

RM2,000 |

| 12 months |

3% one-time upfront handling fee |

RM1,000 |

| 24 months |

5.5% one-time upfront handling fee |

RM2,000 |

| 36 months |

7% one-time upfront handling fee |

RM3,000 |

| 48 months |

9.5% one-time upfront handling fee |

RM5,000 |

|

|

Public Bank Visa Commercial Card

|

RM150 |

18% p.a. |

Apply Now

|

Feature Highlights

- Enjoy a low upfront interest starting from 1.5% interest for up to 48-month balance transfer.

- Give yourself and your company a controlled line of credit for efficient cash flow management only for registered public and private companies.

- We provide our customers with various travel and purchase protection!

Full Travel Protection

- Flying in clients calls for lots of preparation and anxiety, so why not fly your marketing team all the way to them! Not to worry, the Public Bank Visa Commercial has got you covered with Travel Insurance Protection for you and your employees for up to RM1 Million, encompassing accidents and inconvenience experienced during the course of your trip.

Fees and Charges

- It is RM150 for primary card holders with the first year being free of charge.

Are You Eligible For The Public Bank Visa Commercial Card.

- Any business can apply for the Public Bank Visa Commercial Card if the business is earning a minimum annual income of RM100,000 and is 21 years old and above to apply as principal card holder.

Flexibility Fee and Charges

Travel

- Free Automatic Travel Insurance of up to RM1 Million when charging your travel arrangements to this credit card. Claim for inconvenience due to luggage delay, luggage loss, flight delay, missed connecting flight, trip cancellations and repatriation expenses.

Premium

- The ability to control credit card usage by employees by imposing spending limits controls, including control on the number of transactions done anytime and anywhere.

Balance Transfer

- Enjoy a low upfront interest starting from 1.5% interest for up to 48-month balance transfer. Minimum credit balance transfer is RM1,000.

Card Information

-

-

-

Min. Monthly Income

RM8,333.33

-

Min. age for principal holder

21 and above

-

Finance charges

| PAY OVER |

WITH INTEREST RATE AT |

WHEN YOU SPEND |

| 6 months |

1.5% one-time upfront handling fee |

RM1,000 |

| 9 months |

2% one-time upfront handling fee |

RM2,000 |

| 12 months |

3% one-time upfront handling fee |

RM1,000 |

| 24 months |

5.5% one-time upfront handling fee |

RM2,000 |

| 36 months |

7% one-time upfront handling fee |

RM3,000 |

| 48 months |

9.5% one-time upfront handling fee |

RM5,000 |

|

|

Public Islamic Bank MasterCard Gold Credit Card-i

|

RM150 |

15% p.a. |

Apply Now

|

Feature Highlights

- No frills Islamic credit card that gives competitive cash rebate on shop spending.

- 0% balance transfer plan and many banking benefits.

- Most importantly, there is a 2% cashback for groceries.

0% Balance Transfer Plan

- Do you own multiple credit cards? Why not transfer all of your other outstanding balances into a flexible instalment plan instead? With Public Bank’s 0% Balance Transfer Plan, you may convert your outstanding balances from different credit cards and enjoy ZERO management fee and a 6-month instalment plan. You just have to make sure that the outstanding balances reach RM1,000 or above before being eligible for this balance transfer plan.

Fees and Charges

- It is RM150 for primary card holders with the first year being free of charge. It can be waived when you swipe 12 times for subsequent years. On the other hand, RM100 is charged for supplementary card holders.

Are You Eligible For The Public Islamic Bank MasterCard Gold Credit Card-i.

- Anybody can apply for the Public Islamic Bank MasterCard Gold Credit Card-i if you are earning a minimum annual income of RM24,000 and is 21 years old and above to apply as principal card holder and to be at least 18 years old for holding a supplementary card.

Flexibility Fee and Charges

Cashback

- Earn 2% cashback on grocery purchases, credited into your account every month, capped at RM30 per monthly statement cycle (combined between Principal and Supplementary accounts). Activate your new credit card and get rewarded with 50% cashback on your first grocery transaction, valid till 31 July 2021. Terms and conditions apply.

Premium

- Every month, 0.1% of your dining spending will automatically be donated to the Yayasan Waqaf, capped at RM100 per monthly statement cycle.

Balance Transfer

- Take advantage of savings and flexibility when you transfer your outstanding credit card debts of RM1,000 or above to Public Bank credit card to benefit from ZERO management fee and a 6-months instalment plan.

Card Information

-

-

-

Min. Monthly Income

RM2,000

-

Min. age for principal holder

21 and above

-

Min. age for supplementary holder

18 and above

-

Fee for supplementary holder

RM100.

|

|

Public Bank MasterCard Standard

|

RM75 |

15% p.a. |

Apply Now

|

Feature Highlights

- Pay as low as 1.5% interest for up to 48 months tenure.

- No first-year annual fee.

- Zero Interest means there’s NO interest to pay for up to 36 months on retail transactions you choose to convert to Public Bank’s Zero Interest Instalment Plan.

Not one but two EPPs

- Make your shopping experience more satisfying and less worrying with not one but TWO installment payment plans! When you swipe your credit card at Public Bank’s participating retail stores, you can call the bank to request for ZIIP and choose a tenure that you are most comfortable with to repay the loan as it costs you not a single charge! All you are required is to transact a minimum of RM500 in a single receipt.

Fees and Charges

- It is RM75 for primary card with the first year being free of charge. It can be waived when the card reaches 12 swipes per year. For supplementary card holders, there is a charge of RM45.

Are You Eligible For The Public Bank MasterCard Standard.

- Anybody can apply for the Public Bank MasterCard Standard if you are earning a minimum annual income of RM36,000 and is 21 years old and above to apply as principal card holder and to be at least 18 years old for holding a supplementary card.

Flexibility Fee and Charges

Round the Clock Helpdesk

- Having a midnight credit card emergency? Don’t worry as Public Bank has dedicated 24-hour customer service for you. You can dial 03-2176 8555 to lodge a report on lost or stolen credit card or if you want to find out more about your Public Bank MasterCard Standard status, you can call 03-2176 8000.

Premium