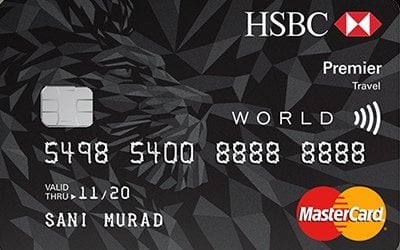

Feature Highlights

- Enjoy up to 12 complimentary visits at Plaza Premium Lounge for primary cardholder, and Wallet Protection Insurance and e-Commerce protection by MasterCard.

- Get Grab complimentary rides with a minimum spend of RM2,500 per transaction on airline ticket(s),

- Splurge on your favorite backpacking gears, and earn Air Miles with a host of travelling benefits and privileges now!