Feature Highlights

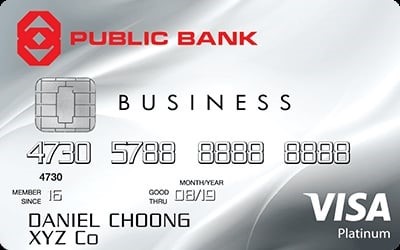

- Take charge of your business with Public Bank Visa Business and provide your employees with a secure line of credit and concentrate on growing your business.

- Earn cashback on everything! 0.50% for all kinds of company spending.

- Enjoy 1.5% interest for a 6-month tenure with a minimum amount of transfer at RM1,000.