Feature Highlights

- Enjoy a low upfront interest starting from 1.5% interest for up to 48-month balance transfer.

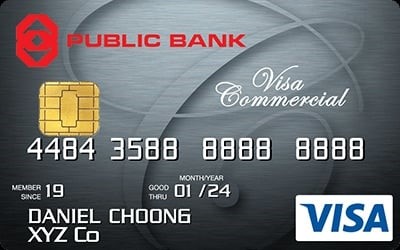

- Give yourself and your company a controlled line of credit for efficient cash flow management only for registered public and private companies.

- We provide our customers with various travel and purchase protection!