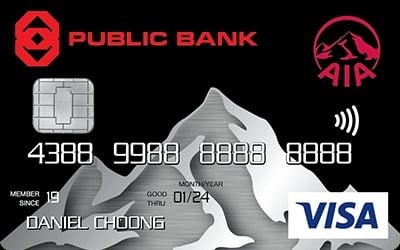

Feature Highlights

- A gold cashback credit card that gives unlimited 0.2% cash rebate on AIA Insurance Premium payments.

- Enjoy 0.1% Cash MegaBonus on your retail purchases.

- Enjoy low and competitive interest rate starting from 0% p.a. with flexible repayment terms of your choice with Public Bank credit card instalment plans.